Vietnam's export of agricultural products to the Middle East - Africa: reality and solutions

14:15 - 12/03/2021

M.Econ. Nguyen Khanh Linh

Vietnam Institute of Industrial and Trade Policy and Strategy

1. Characteristics and demand for agricultural products of the Middle East - Africa market

The Middle East (including 15 countries) and Africa (including 55 countries), with a population of more than 1.6 billion people and a large purchasing power, are currently consider potential markets for agricultural and aquatic products of Vietnam. This is a market area with a great demand for imported goods, especially agricultural and aquatic products to compensate for the shortage of agricultural products and foodstuffs to meet domestic demand due to the extreme natural conditions it is not suitable for farming. Middle East countries with GDP in 2018 reached 3,452 billion USD, GDP growth rate of 2.2% and GDP/person is high, currently importing a large number of food and foodstuffs, accounting for 80 % of the goods consumed in this area, equivalent to about 45 billion USD per year. In 2019, the region's food and foodstuff imports reached 46.72 billion USD, expected to increase to 70 billion USD by 2025. Meanwhile, in 2019, the import turnover of agricultural products and foodstuffs of African countries is 36.67 billion USD and is expected to increase sharply to 110 billion USD by 2025.

* In the Middle East, the top important markets for Vietnam's agricultural products and food exports are the United Arab Emirates (UAE), Iraq, Israel and Egypt. In particular, the UAE mainly imports food, agricultural products, food to serve domestic needs and ensure food security. Currently, this market has to import about 80% of food in general to serve indigenous people, tourists, and immigrants. In addition, coffee is currently a popular drink in the UAE with more than 80% of the population consuming it daily. The UAE has traditionally been the hub for agricultural re-exports of both the Middle East and Africa, so it is a potential market for Vietnam's agricultural exports. Iraq is one of the largest rice importers in the Middle East and in 2018 emerged as Vietnam's largest import market for rice and cereal products. Israel is the country with the highest import demand in the Middle East for seafood and processed seafood, including fruits from tropical countries. Egypt is also a country with developed agriculture but still needs to import a variety of agricultural products, foods such as coffee, tea and spices, meat and by-products from meat, seafood, fruit ... to serve production and consumption in the country.

* Africa is currently a market with a large demand for importing agricultural products, especially in the West Africa region has a large demand for rice due to insufficient rice production, especially in years of natural disasters, crop failures, political instability, or disease. In the African region, some important agricultural import markets that Vietnamese enterprises should pay attention to are Ghana, Cote d’Ivoire, South Africa and Algeria. In particular, Ghana and Cote d’Ivoire are the leading import markets for Vietnam's agricultural and aquatic products, mainly rice imports to compensate for the shortage of food consumption. Next is Algeria with great import demand for pepper, tea, coffee, spices, rice, cereals, dairy products, seafood, meat and meat by-products. South Africa is a country with developed agriculture, but every year, there is still a need to import a variety of agricultural products and foods, with a large demand for pepper, tea, coffee, spices, fruits and seafood of all kinds...

Vietnam has traditional political, diplomatic and friendly cooperation relations with all Middle Eastern countries. The legal framework is quite adequate for developing and strengthening partnerships. Moreover, 10 out of 15 Middle East countries are WTO members (except Iran, Yemen, Iraq, Syria, Lebanon) and the Gulf Cooperation Council (GCC) consists of 6 countries, creating a common market block with the application of low import tariffs of 0% -5% on goods imported from outside the bloc, is an advantage in trade with this region. On March 21st, 2018, at the African Union (AU) Summit held in Kigali, Rwanda, 44 African countries signed the African Continental Free Trade Agreement (AFCFTA), which officially took effect from May 30th, 2019, making Africa the largest free trade region in terms of the number of participating countries since the World Trade Organization was established.

However, the Middle East - Africa region with complicated political characteristics, instability, religious conflicts, national conflicts, resource disputes, and conflicts of influence between major countries often occur. Besides, some barriers to import and export activities of countries with this market are that, if enterprises want to export agricultural products and foodstuffs to this market area require Halal certification as a required condition, plus some other food safety standards. These regional countries require certificates of standards, quality accreditation, labels ... issued by the Gulf Metrology and Standards Organization (GSMO).Turkey and Saudi Arabia are countries that regularly apply trade remedies (anti-dumping, safeguard ...), technical barriers, and strict Halal certification requirements for imported food. Moreover, the Middle East - Africa market area is quite difficult to access due to some characteristics such as cultural differences, religion, food use habits, or business practices..

2. Assessment of the reality of Vietnam's agricultural exports to the Middle East - Africa market in the period 2015-2019

2.1. Achievements and results

- Over the past years, Vietnam's exports of agricultural and aquatic products to the Middle East - Africa have seen much prosperity, with the total export turnover of agricultural and aquatic products reaching 1,774.9 million USD in 2018, of which the export of agricultural and aquatic products to the Middle East reached 945.7 million USD, up sharply by 10.69% compared to 2017 (reaching 854.4 million USD) (higher than the average growth rate of the whole period 2014-2018 at 5.18%); export of agricultural and aquatic products to the African region reached 829.2 million USD, up 2.82% compared to 2017 (reaching 806.5 million USD) (higher than the average growth rate of the whole period 2014-2018 at 0.23%)[1].

- The group of agricultural and aquatic products is one of the important export commodity groups of Vietnam to the Middle East - Africa market region, with the proportion of export turnover of this commodity group in the total export turnover of Vietnam goods to the Middle East in 2018 reached 10.84% (average in the period 2014-2018, accounted for 9.91%) and to Africa region reached as high as 32.85% (average in the period 2014-2018 accounted for 29.35%)[2].

- Vietnam's agricultural exports such as rice, coffee, pepper, tea, seafood, fruits, products from cereals, copra ... have penetrated and foothold in the Middle East – Africa market, is favored by local people and highly appreciated for price, design and quality.

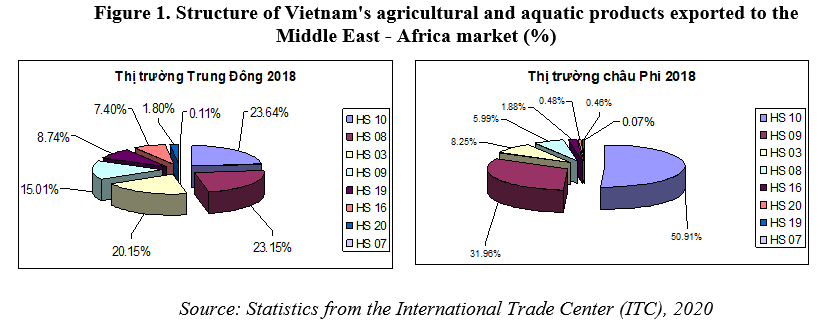

+ In the Middle East market, Vietnam's largest agricultural product export turnover is rice (HS1006), in 2018 reaching a turnover of 223.5 million USD, accounting for 23.64% of the export turnover of agricultural and aquatic products to the Middle East and accounts for 8.34% of the total rice export turnover of Vietnam, but still accounts for a very limited proportion in the total rice import turnover of the Middle East (only 1.02%). The second is fruit products (HS08), in 2018 reaching a turnover of $ 218.8 million, accounting for 23.15% of the export turnover of agricultural and aquatic products to the Middle East and accounting for 3.65% of the total fruit export turnover of Vietnam, but accounting for a very limited proportion of 2.63% of the total fruit import turnover of the Middle East. The third is aquatic products (HS03), in 2018 reached 190.6 million USD, accounting for 20.15% of the export turnover of agricultural and aquatic products to the Middle East, accounting for 2.97% of the total seafood export turnover of Vietnam and accounting for 5.94% of the total aquatic products import turnover of the Middle East region.

+ In the African market, rice is still the largest agricultural product export turnover in Vietnam, reaching 422.2 million USD in 2018, accounting for 50.91% of the export turnover of agricultural and aquatic products to Africa and 15.76% of the total rice export turnover of Vietnam. The second is pepper, tea, coffee, and other spices (HS 09), in 2018 with a turnover of 265.0 million USD, accounting for 31.96% of the export turnover of agricultural and aquatic products to Africa and 6.51% of the total export turnover of this commodity group of Vietnam. The third is aquatic products (HS03), in 2018 with a turnover of 68.5 million USD, accounting for 8.25% of the export turnover of agricultural and aquatic products to Africa and accounting for 1.07% of total aquatic products export turnover of Vietnam.

- Taking advantage of the opportunity to import a large variety of food and foodstuff products in a large number of countries in the Middle East - Africa, Vietnam has gradually expanded its export market for agricultural and aquatic products to this potential region.

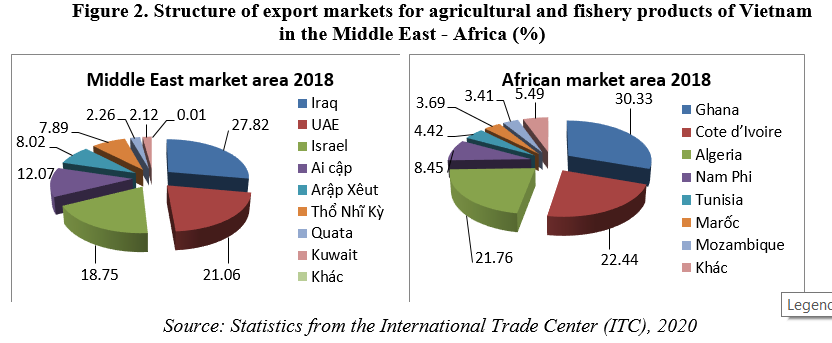

+ In the Middle East, in 2018, the top three important markets for Vietnam's agricultural and food exports are the United Arab Emirates (UAE), Iraq, Israel, there are also Egypt, Saudi Arabia, Turkey, Qatar and Kuwait...In this region, Iraq, although only the 5th largest commodity import market of Vietnam, is the largest import market for Vietnam's agricultural and fishery products, with the total import turnover in 2018 reaching 263.1 million USD, accounting for 27.82% of the total export turnover of Vietnam's agricultural and aquatic products to the Middle East region, with the main imported items in 2018 are rice, cereal products, flour, starch, milk, and fruit. The United Arab Emirates (UAE) is the largest commodity import market of Vietnam in the Middle East, but is the second largest import market for agricultural and fishery products of Vietnam, with total import turnover in 2018 reached 199.18 million USD, accounting for 21.06% of the total export turnover of agricultural and aquatic products of Vietnam to the Middle East region, with the main import items in 2018 being seafood, fruits, pepper, tea, coffee, other spices and rice. Israel is the third largest import market for Vietnam's agricultural and fishery products, with a total import turnover in 2018 reaching 177.37 million USD, accounting for 18.75% of Vietnam's total exports of agricultural and aquatic products to this region, with the main imported items in 2018 being fruits, seafood, pepper, tea, coffee, and spices ...

+ In the Africa region, in 2018, the top three important markets for Vietnam's agricultural and food exports are Ghana, Cote d'Ivoire and Algeria, in addition to South Africa, Tunisia, Morocco and Mozambique...In this region, Ghana is the second-largest import market for commodities, but the largest import market for Vietnam's agricultural and aquatic products, with the total import turnover in 2018 reaching 216.9 million USD, equaling 0.33% of the total export turnover of agricultural and aquatic products of Vietnam to the Africa region, in which, this country mainly imports rice (HS10) with a turnover up to 214.1 million USD, equaling 50.72% of Vietnam's rice export turnover to Africa. Cote d'Ivoire is the fifth largest commodity import market but the second largest import market for Vietnam's agricultural and aquatic products, with the total import turnover in 2018 reaching 160.5 million USD, equaling 22.44% of the total export turnover of agricultural and aquatic products of Vietnam to the Africa region, of which the main imported commodity in 2018 was rice (HS10) with 156.5 million USD, equaling 37.08% of Vietnam's rice export turnover to the African region. Algeria is the third-largest commodity import market and also the third largest import market for Vietnam's agricultural and aquatic products, with the total import turnover in 2018 reaching 155.6 million USD, equaling 21.76% of the total export turnover of agricultural and aquatic products of Vietnam to the Africa region, with the main imported items in 2018 are pepper, tea, coffee, other spices, seafood, rice...

2.2. Shortcomings and causes

2.2.1. Shortcomings

- Although Vietnam's exports of agricultural and aquatic products to the Middle East - Africa region have achieved encouraging results. However, the Middle East - Africa market still occupies a relatively modest position among export markets for Vietnam's agricultural and aquatic products. In 2018, the proportion of Vietnam's agricultural and fishery exports to the Middle East in the total export turnover of Vietnam's agricultural and fishery products accounted for only 4.08% (average period 2014-2018 accounts for 4.0%) and to Africa only 3.58% (average period 2014-2018 accounts for 3.9%)

- Compared with the demand for agricultural and aquatic products in the Middle East - Africa, the ability to meet Vietnam's export agricultural and aquatic products is still very limited, with the share of Vietnam's agricultural and fishery exports in the Middle East's total imports of agricultural and fishery products, only 1.76% in 2018, while for the Africa region this in 2017 was 2.05%.

- Vietnam's methods of exporting agricultural products are not suitable and have not yet met the Muslim people's consumption customs and practices on the way of agricultural product packaging and distribution, tastes, especially the achievement of Halal Food Certification (certifies the product meets the requirements and is allowed to use by Muslims). Currently, only nearly 1,000 Vietnamese enterprises meet this standard - a number that is too small compared to 300,000 enterprises established each year. Moreover, there is currently no Common Halal Certification for the whole world, but this is just the specific standard of Islam, not recognized by any prestigious agency of the world. Therefore, this is one of the major barriers causing difficulties for Vietnamese enterprises when exporting to this market.

2.2.2. Cause of shortcomings

- The first and foremost objective reasons belong to geography, the distance between the two sides makes it very difficult to transport, increase prices and reduce competitiveness, especially for agricultural products and foodstuffs that need freshness and high preservation requirements to ensure product quality. Besides, some specific characteristics of the differences in culture, religion, food usage habits, consumption habits, and different business practices of the Muslim countries of the Middle East - Africa also becomes a barrier in the trade of agricultural products of Vietnam with these regional countries.

- The biggest barrier for Vietnamese businesses to export to the Middle East - Africa market is the payment procedure and method. Importers in this area often offer to buy goods with deferred payment and no letter of credit (L/C) due to high costs, or the payment is made by TTR, 10% deposit, the rest will be paid when vouchers are available. These are unsafe and even risky payment methods, so most of them are not approved by Vietnamese exporters.

- Lack of information on the market, Middle East - Africa partners also cause many obstacles for Vietnamese exporters to access this market. The ability to introduce, promote trade in agricultural products, verify the capacity of importers, apply for a visa ... still face many difficulties, causing Vietnamese businesses to export through international intermediaries, leading to an increase in prices and costs, a decrease in the competitiveness of Vietnam's agricultural and aquatic products exported from Vietnam, and sometimes even the brand of Vietnamese agricultural products is not known to local consumers.

- Enterprises exporting agricultural products of Vietnam still face many difficulties in export markets due to the fierce competition from the local supply of importing countries in the Middle East - Africa, as well as from other major exporters of agricultural products in the world. In 2019, in the Middle East and Africa markets, the biggest competitors to export agricultural products of Vietnam are India, Thailand, China, Indonesia, Malaysia, and Ecuador ...

- Vietnamese agricultural products are facing fierce competition in the Middle East - Africa market because exporters of some countries accept deferred payment, while Vietnamese businesses require immediate payment, many partners turn to choose to import from these foreign businesses, especially businesses from countries like India, China or Thailand.

- Between Vietnam and countries in the Middle East - Africa region has not signed a Free Trade Agreement (FTA), therefore, import tax and technical barriers to control the import of agricultural products are not stable and inconsistent

- In addition, market access and business development in Middle East countries also face several challenges such as the US-Turkey trade war, civil wars, religious conflicts, ethnic conflict ..., easy to cause risks in contract performance.

- 3. Proposing some solutions to promote the export of agricultural products of Vietnam to the Middle East - Africa market

3.1. Continue to improve legal frameworks, mechanisms and policies to facilitate trade exchange of agricultural products and investment cooperation between Vietnamese enterprises and Middle East - African countries

- Continue to improve legal frameworks, mechanisms and policies to facilitate trade exchange of agricultural products and investment cooperation between Vietnamese enterprises and the Middle East - African countries, well implementing the objectives of ensuring food security and energy security, including policies towards encouraging and enabling Vietnam to import crude oil, liquefied gas and other petrochemical products, raw materials… from the Middle East-Africa region, at the same time promoting the export of food products, processed foods, vegetables, fruits and seafood to meet the consumption demand of countries in the Middle East - Africa.

- Create an open and transparent investment environment, promulgate mechanisms and policies to attract Middle East-African investors to invest in Vietnam in the fields of industry, energy, renewable energy, and agricultural production, aquaculture and food processing.

3.2. Strengthening cooperation between Ministries, functional sectors, Chamber of Commerce and Industry, and business associations of the parties to promote the development of trade in agricultural products

- Strengthen exchanges of ministerial and sectoral delegations as well as business delegations to promote mutual understanding and cooperation in the field of agriculture and agricultural exports based on equality and mutual benefit; strengthen trade and investment cooperation to ensure food security and energy security of all parties.

- Actively promote bilateral cooperation through the Joint Committee/Intergovernmental Committee channel between Vietnam and countries in the Middle East – Africa.

- First of all, it is necessary to strengthen cooperation with partners in the Middle East as a transit station for Vietnam's agricultural exports to enter the African market. Middle East countries have 95% of foreign currency earned from oil and gas processing and export, along with that, the international banking system is very developed, so the solvency and payment capacity in this market is quite good. Besides, 10 out of 15 countries currently join the WTO with the support of the Gulf Cooperation Council (GCC), so products exported to these markets will enjoy tax incentives from 0 - 5%.

3.3. Strengthen information, propaganda and introduction about markets and import partners, participate in trade promotion activities, annual fairs and exhibitions on agricultural products and foodstuffs in the Middle East - Africa

- Before the current reality of two-way communication between Vietnam and the Middle East - Africa countries, there are certain shortcomings, it is necessary to strengthen communication activities to create a rich and reliable source of information about the market, thereby raising awareness for enterprises of both sides about the great potential of the market and opportunities to expand investment, promote import and export.

- Support enterprises exporting agricultural products of Vietnam through Vietnamese representative offices in this region, with public-private cooperation models and diplomatic activities serving economic goals in the country departments in the Middle East - Africa to increase market advice and support, especially to support Vietnamese enterprises in verifying the capacity of import partners to minimize risks in the investment process, import and export payment and expand cooperation, promote export of agricultural products. Connect with the authorities in the host country, connect with prestigious local organizations and business associations to promote trade in agricultural products, or participate in product fairs abroad, introduce Vietnamese agricultural product exporters to participate in cooperation models and projects and open training courses on Halal certification.

3.4. Solutions for agricultural export enterprises

- Enterprises should carefully study the political situation on the mass media, warn on the websites of the Ministry of Industry and Trade, after the political situation has stabilized, the need to import goods, especially for agricultural products and foodstuffs that have only increased to export. To limit risks, businesses need to fully understand traders and markets, thoroughly learn about import and export regulations of the local market; be cautious in finding customers online and be wary of too lucrative deals to avoid fraud, money laundering or money transfers for import procedures.

- Effective use of consulting services to verify partners, carefully verify import partners before the transaction (request for business registration license, import-export card), help with negotiating, sign, execute the contract smoothly and be ready for dispute resolution.

- Limit payment risks when customers request to pay in the form of T/T (Telegraphic Transfer) or D/P (Documents against payment), deferred payment, do not open L/C, buy CIF by giving a deposit of% to ensure the safety of orders (preferably 30% or more), or suggest that importers use irrevocable L/C to open at reputable banks, and at the same time limit deferred payment to customers; should not use D/A (Document Acceptance) or transfer money by Western Union for contract payments.

- Strengthen direct meetings and contact with import partners through participating in trade promotion programs for agricultural products, fairs and exhibitions held in countries in this region.

- Develop an appropriate market access strategy, research and manufacture export products with quality, specifications and designs following the regulations on quality standards and consumption practices of this market.

- Research on the possibility of building a product distribution network and opening representative offices, branches, or bonded warehouses in the Middle East - Africa region to facilitate business in this area.

- In addition to investing in promoting brands of Vietnamese agricultural products in countries in the region, businesses need to pay special attention to building and developing brands of Vietnamese agricultural products, improving product quality, maintaining future between the quality and price of agricultural products.

- Pay special attention to training human resources in agricultural enterprises, building a team of engineers qualified in science - technology and skilled workers; building a contingent of qualified import-export business staff, proficient in foreign trade and foreign language skills, regularly improving skills in negotiating and signing contracts (applying model contracts).

REFERENCES

- Tran Thanh Long (2014), "Xuat khau thuy san Viet Nam va rao can thuong mai quoc te", Banking Technology Review, 98 (2014).

- Ngo Thi Tuyet Mai (2012), “Quan diem va giai phap phat trien xuat khau ben vung hang nong san Viet Nam”, Journal of Economics& Development,National Economics University (ISSN: 1859-0012).

- “Tiem nang lon xuat khau nong san, thuc pham sang Trung Dong, chau Phi” (2018), vn

- “Co hoi rong mo cho doanh nghiep Viet Nam o Trung Dong - chau Phi” (2019),vn

- “Trung Dong - chau Phi: Thi truong tiem nang cho doanh nghiep Viet” (2019), vn

- “Nhieu du dia xuat khau sang thi truong Trung Dong”(2019), vn

- “Trung Dong, chau Phi: Hai thi truong tiem nang nhung day thach thuc voi doanh nghiep Viet” (2019), tapchicongthuong.vn

- Statistics of the International Trade Center (ITC) based on UN COMTRADE statistical database (2020).