Opportunities and solutions for cross-border E-commerce development between Vietnam and South Korea

10:54 - 05/11/2024

Nguyen Thao Ngoc[1]

Vietnam and South Korea established diplomatic relations in 1992, elevated their partnership to a Strategic Cooperative Partnership in 2009, and further upgraded it to a Comprehensive Strategic Partnership in 2022. Since then, the bilateral relationship has grown significantly across various sectors. Beyond investment and trade, the cooperation between the two nations has expanded to encompass tourism, culture, science, technology, and digital economy development, particularly e-commerce. Cross-border e-commerce has become an inevitable trend, and cross-border e-commerce or online import-export activities have gained increasing popularity in Vietnam.

Keywords: Cross-Border E-commerce; Vietnam - South Korea Relation.

- The Current State and Opportunities for the Development of Vietnam-South Korea Cross-Border E-commerce

Vietnam is one of the fastest-growing e-commerce markets in Southeast Asia. From 2015 onwards, the three largest digital economies in the region have experienced an average growth rate of 35-36%. India has recorded the highest growth rate at 41%, followed by Vietnam at 36% and the Philippines at 30%. In recent years, Vietnam's e-commerce market has expanded rapidly and has become a popular business model among both enterprises and consumers. The diversity of business models, participants, operational processes, and supply chains, supported by modern internet infrastructure and technology applications, has made e-commerce a crucial pillar in the country's digital economic development. E-commerce empowers consumers to shop internationally via the internet, transforming them into "global consumers". Simultaneously, it facilitates individuals and businesses to introduce and distribute their products to international customers. Moreover, participating in online import-export systems and cross-border e-commerce channels creates opportunities for Vietnamese businesses to exchange, learn from real-world experiences, enhance their capabilities, and improve the quality of Vietnamese-made products, thereby bringing Vietnamese brands to consumers in many global markets.

Meanwhile, e-commerce is booming, and international e-commerce platforms as well as foreign products are making significant waves in the Vietnamese market. Market research figures have confirmed this trend. According to Metric, a leading e-commerce data provider in Vietnam, the total revenue of the top 5 e-commerce platforms in the first half of 2024 reached 143.9 trillion VND, a 54.91% increase compared to the same period in 2023.

South Korea is one of the few countries that have signed numerous bilateral and multilateral FTAs with Vietnam. The two countries have participated in FTAs such as the ASEAN-Korea Free Trade Agreement (AKFTA), the Vietnam-Korea Free Trade Agreement (VKFTA), and the Regional Comprehensive Economic Partnership (RCEP). In 2023, Vietnam surpassed Japan to become South Korea's third-largest trading partner, although bilateral trade with this country decreased compared to 2022. Statistics show that in 2023, bilateral trade between Vietnam and South Korea reached 76.1 billion USD. In the first six months of 2024, total two-way trade between Vietnam and South Korea was estimated at 38.8 billion USD, an increase of 9.3% compared to the same period in 2023. Of this, Vietnam's exports reached 12.2 billion USD, up 9.9%, and imports reached 26.6 billion USD, up 9.1%.

In the trade cooperation relationship, the export structure of Vietnam and South Korea has a clear complementary nature and little direct competition. Vietnam mainly exports products manufactured by Korean foreign-invested enterprises (FDI) such as phones and components, computers, electronic products and components, machinery, equipment, and spare parts, as well as Vietnamese products with strengths such as agriculture, seafood, processed food, textiles, footwear, and wood products.

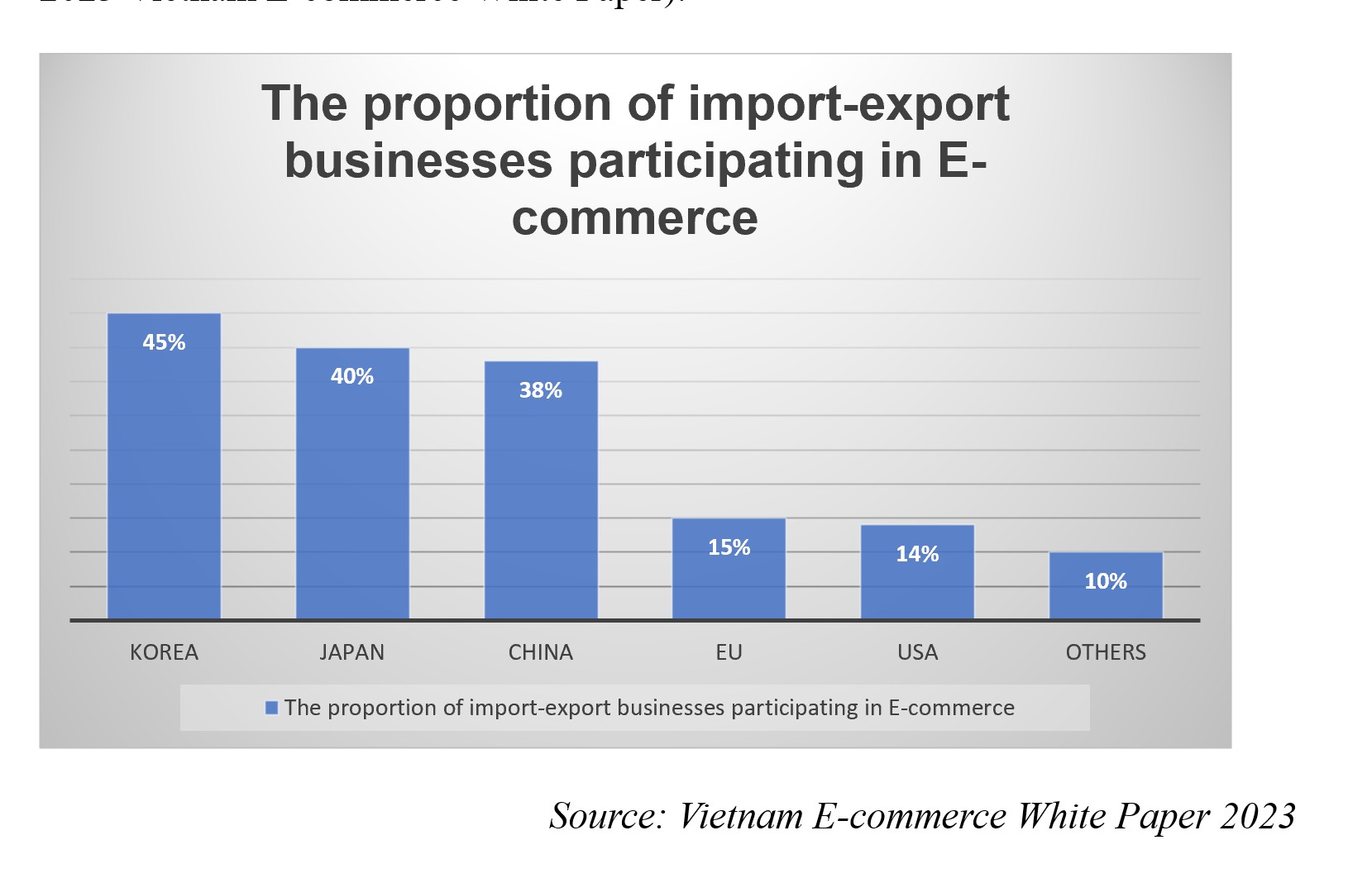

Conversely, South Korea is the second largest supplier after China of components, accessories, machinery, equipment, and raw materials as inputs for Vietnam's manufacturing industry, especially for export-oriented manufacturing industries. Notably, South Korea is the country with the second largest trade surplus with Vietnam after China. In e-commerce, South Korea has the highest percentage of businesses participating in e-commerce exports - 45% in 2023 (according to the 2023 Vietnam E-commerce White Paper).

In fact, approximately 75% of internet users in Vietnam make purchases through e-commerce platforms. The average annual spending per person has increased significantly year-on-year, and purchasing power is also on the rise.

In fact, approximately 75% of internet users in Vietnam make purchases through e-commerce platforms. The average annual spending per person has increased significantly year-on-year, and purchasing power is also on the rise.

Shopee, Vietnam's most popular e-commerce platform, opened its doors to sellers from Indonesia and South Korea in early 2021, allowing them to sell on Shopee Vietnam. Most Shopee shops from South Korea (Shopee Korea) sell cosmetics. This has raised concerns among Vietnamese cosmetics sellers about competition from these online stores. Not only do they feature popular brands, but many Shopee Korea sellers also sell on Shopee Mall, which has boosted consumer confidence in Vietnam and also poses a competitive threat to local cosmetics retailers. By selling through Shopee, these Shopee Korea sellers can avoid import duties, resulting in lower product prices compared to other importers of Korean cosmetics.

Shopee Korea, one of the largest e-commerce platforms in Southeast Asia, has identified Vietnam as a rapidly growing market, ranking first in terms of order volume and second in terms of sales among all markets where Shopee holds large-scale discount events like the "9.9 Super Shopping Day". The most popular category of Korean products on Shopee Vietnam is beauty products. From January to August this year, the cumulative number of orders for beauty products increased by 90% compared to the same period in 2022. This was followed by the "hobbies" category, which includes products related to K-pop and food.

As Korean products gain popularity in the Vietnamese market, sellers on Korean e-commerce platforms are achieving remarkable results. In the beauty sector, early entrants, including best-selling brands like COSRX and Some By Me, have shown impressive performance. Analysis shows that Vietnamese consumers tend to prioritize skincare products over makeup, and Korean beauty products with guaranteed quality have captured the hearts of local consumers.

Moreover, Vietnamese brands are also gaining popularity and significant potential in the Korean e-commerce market. On October 5, 2023, Injoon Song, a Korean entrepreneur, launched Chus, an e-commerce platform exclusively for unique Vietnamese products. With over 500 brands and 6,000 Vietnamese products, including handicrafts, local specialties, and limited-edition consumer goods, Chus serves both domestic consumers and foreigners living and working in Vietnam. The launch of this e-commerce platform not only brings convenience to consumers but also creates a community of people who love, appreciate, and support high-quality Vietnamese products.

Based on these analyses, the potential for the development of cross-border e-commerce between Vietnam and South Korea is immense, promising to bring value to e-commerce businesses in both countries. In reality, there are still many opportunities for Vietnam's e-commerce to grow in the Korean market, but this also brings along many challenges and high competitiveness for retailers on domestic e-commerce platforms.

- Challenges in Vietnam-Korea cross-border e-commerce

Firstly, there are legal challenges. Cross-border e-commerce requires cooperation among countries to create a harmonized business environment. However, differences in legal regulations across countries can complicate the handling of issues related to contracts, payments, security, and intellectual property.

The management of cross-border e-commerce activities still faces some difficulties and obstacles. Specifically, to measure the number of transactions from international platforms operating in Vietnam for management purposes, the published data of enterprises is insufficient. There is a need for data and information coordination from functional management units such as customs, tax, and banks in managing goods clearance or managing transaction flows. This involves sharing and connecting databases to synchronize and enhance management, which is being implemented by agencies but still faces difficulties, especially in the form and format of data sharing between agencies.

In addition, the administrative penalties for violations are not yet sufficiently deterrent. Some violations have not been specifically amended or supplemented in Decree 85 and the Consumer Protection Law of 2023, leading to difficulties in verifying the identity of foreign merchants and organizations selling goods on e-commerce trading platforms, and in resolving consumer complaints related to goods and services provided by foreign merchants.

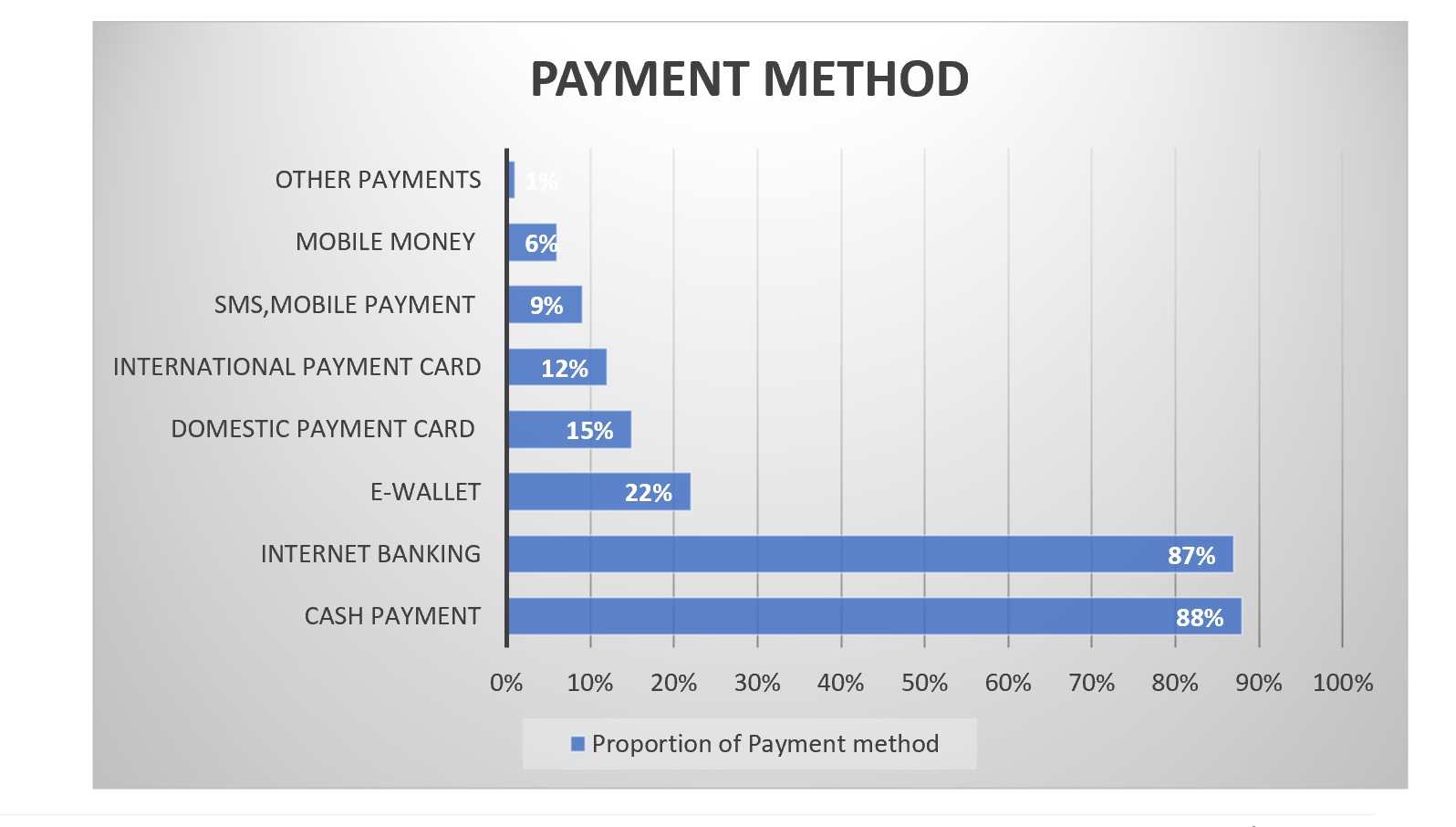

Secondly, regarding payment methods, cross-border e-commerce requires the integration of payment systems to allow transactions to take place conveniently and securely. However, differences in the types and methods of payment between countries can slow down the payment process and increase costs for businesses. Moreover, Vietnamese businesses still use traditional payment methods such as cash and domestic transfers to a relatively large extent (87% - 88%), leading to difficulties in international transactions.

Thirdly, cultural, linguistic, and knowledge barriers regarding e-commerce operations pose significant challenges for Vietnam's cross-border exports. Vietnamese businesses currently focus on domestic online sales or, at best, promoting Vietnamese brands internationally. While domestic e-commerce has made significant strides, e-commerce for exporting businesses remains relatively new, with many complex legal procedures, regulations, and unfamiliarity with international e-commerce platforms (Ministry of Industry and Trade, 2021). Moreover, the expanding scale of export markets requires businesses to conduct market research on foreign consumer preferences, where language and culture are significant challenges for Vietnamese businesses. Furthermore, exporting businesses are still unfamiliar with identifying and finding partners in countries with different time zones from Vietnam (Nguyen Thi Thanh Nhan, 2017).

Fourthly, participation in numerous agreements has created competitive pressure as many countries in the agreements have similar product structures but higher competitive capabilities. Although Vietnamese businesses have gradually demonstrated their capabilities through the quality of their export products in recent years, they are still generally weaker compared to other countries in the region. A typical example is the garment industry, where Vietnam has relatively good production resources, but brands are still small and have not yet established a position in the international market. Additionally, cross-border e-commerce allows Vietnamese goods to reach more international markets but also intensifies competition in the domestic market. The story of authentic Korean cosmetics arriving in Vietnam within 7-9 days is an example. Not only do they have an advantage in delivery time, but the shipping fees for orders from Korea to Vietnam are also significantly more advantageous compared to domestic orders or orders within the same province. Currently, domestic shipping fees of some large shipping businesses range from 18,000 to 25,000 VND (for urban areas or a region) and from 25,000 to 35,000 VND for domestic shipping, even up to 40,000 VND. Meanwhile, for many orders from Korea, Vietnamese customers enjoy free shipping or shipping fees as low as 10,000 to 15,000 VND per order.

Fifthly, e-commerce in general and online exports in particular also pose many risks for Vietnamese businesses, including differences in culture, processes, foreign exchange, standards between countries, payments, mechanisms, policies, and politics (Hong Loan, 2021). According to statistics from the Department of E-commerce and Digital Economy, in 2020, a survey of nearly 4,500 businesses showed that the rate of fake orders and unsuccessful transactions on websites and applications was as high as 19.4%. Moreover, shipping companies and payment methods also pose many risks for exporting businesses as well as consumers. 50% of businesses believe that applying e-commerce in export activities is ineffective.

Finally, Vietnam's digital infrastructure, platforms, and workforce remain underdeveloped. Businesses' investment in training and supply chain management has been inadequate. Moreover, management skills in e-commerce, both within enterprises and among government officials, are still weak, and the number of dedicated officials in the Department of Industry and Trade is limited. Furthermore, most localities have been struggling to provide training to improve the skills of businesses and households. Infrastructure remains a weakness of domestic commerce. To have a good infrastructure, not only connectivity is required but also well-planned investment policies and strategies, especially for logistics and digital platforms such as e-commerce marketplaces. The report of the Ministry of Industry and Trade frankly acknowledges that the growth of domestic commerce still lacks close linkages between the parties in the goods supply chain (manufacturers, distributors, transporters, and consumers).

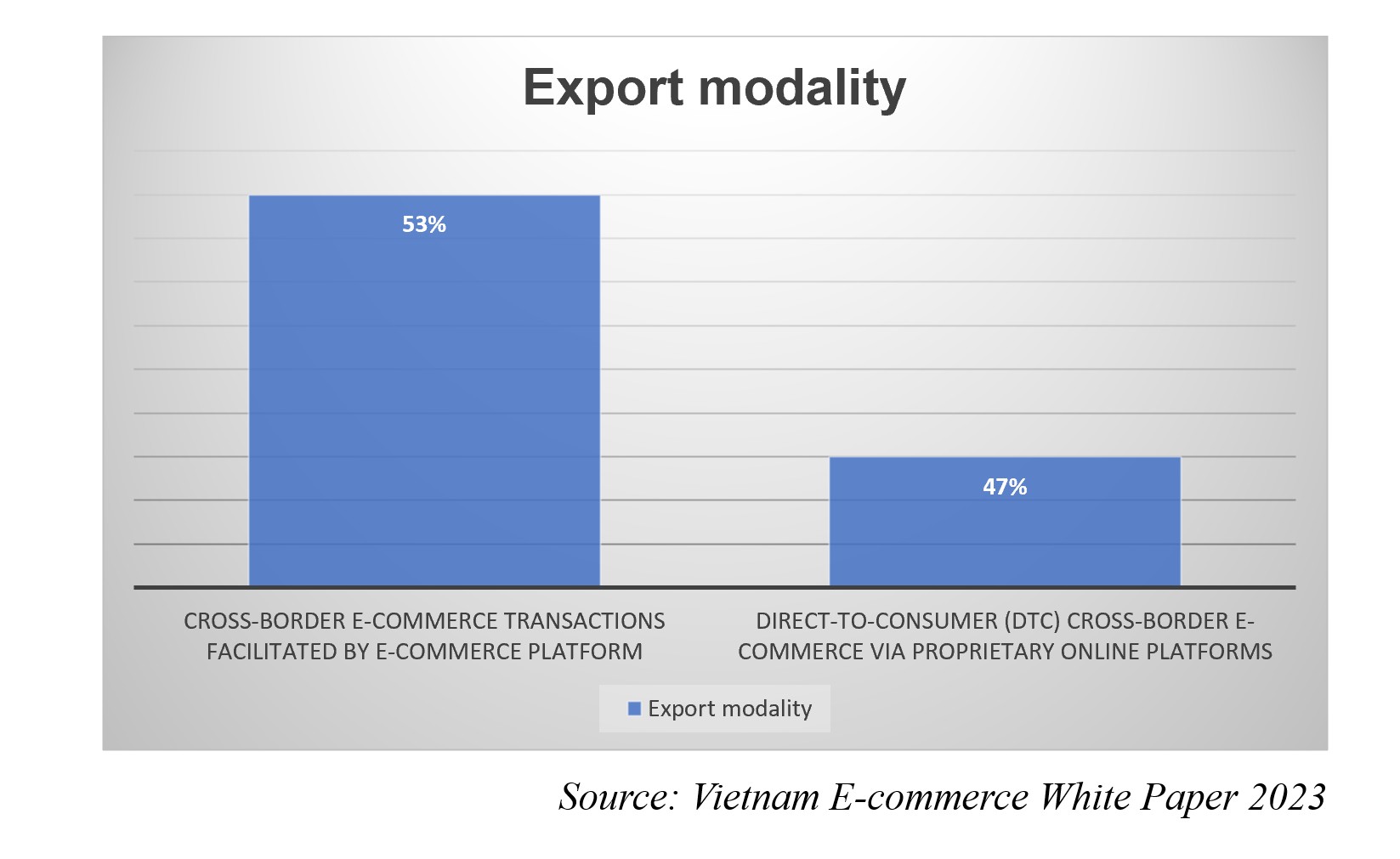

Despite a significant increase in the adoption of e-commerce platforms for exports in 2023 (over 50%), the overall utilization of e-commerce tools for import-export activities remained relatively low at 13%. While 60% of businesses primarily relied on e-commerce marketplaces, a growing number (47%) were also leveraging self-built websites. Japan, South Korea, and China continued to dominate as the primary export markets for Vietnamese businesses, indicating ample room for expansion into other markets.

- Several critical solutions to foster the growth of Vietnam-Korea cross-border e-commerce

To foster robust and comprehensive development of Vietnam-Korea e-commerce, several solutions should be considered:

Firstly, regarding the legal framework, a decree on customs management for e-commerce import and export should be promptly issued to differentiate between regular goods and e-commerce goods, and to enhance inspection and handling of origins to prevent counterfeit goods. Clear regulations on electronic contracts, online payments, intellectual property protection, and consumer protection in cross-border e-commerce should be established. Efforts should be made to align Vietnamese e-commerce laws with international standards, facilitating participation in free trade agreements. Moreover, an efficient dispute resolution mechanism should be established between the two governments, particularly for disputes arising from cross-border e-commerce.

Secondly, regarding government management in e-commerce, mechanisms should be established to control violations in e-commerce transactions, such as website establishment, violations of information and transactions on websites or mobile applications, violations of e-commerce service provision, violations of personal data protection, and violations of evaluation, supervision, and authentication in e-commerce.

Thirdly, the quality of human resources should be improved through training. E-commerce requires a close relationship between producers, distributors, consumers, technologists, and government agencies. Training in both quantity and quality should involve multiple stakeholders. To develop e-commerce, businesses need a workforce with technological and foreign language skills, as well as expertise in website and e-commerce platform management, database management, and online marketing, which are currently difficult for businesses to recruit. Additionally, the government should regularly organize training programs to enhance the knowledge and skills of management cadres and implement human resource development policies. Moreover, the roles of schools, training centers, and media should be promoted.

Fourthly, infrastructure development is essential. Investments should be made in warehousing, transportation, and payment systems to ensure that goods are delivered quickly and safely. A long-term solution is to build an e-commerce logistics system for exports. Additionally, investing in and upgrading e-commerce infrastructure is indispensable for the development of cross-border exports. E-commerce develops in parallel with technology platforms, including information technology, telecommunications, banking technology, and electronic payments. Developing an e-commerce ecosystem should focus on promoting branding and accessing market trends through data and technology. Cross-border e-commerce platforms should be developed, along with e-commerce marketplaces connecting businesses from both countries, supporting payments, transportation, and after-sales services.

Fifthly, domestic enterprises need to enhance their capabilities. Businesses must quickly adapt to regulations on quality, food safety, technological innovation, and comply with processing and production procedures to overcome technical barriers in Korea. When utilizing the Free Trade Agreement, businesses should carefully research and prepare the necessary paperwork, such as certificates of origin (C/O).

Sixthly, promotion and awareness of the Agreement should be enhanced among the business community so that they understand the content, commitments on goods trade, services trade, investment, and the benefits and ways to enjoy the Agreement's preferential treatment for exports to Korea and imports from this market through both traditional and e-commerce channels. Specific information and guidance on how to benefit from the Agreement should be provided to businesses. Negotiations should continue with the Korean side on opening up the market for "items still under negotiation in the VKFTA" to facilitate the entry of these items into the Korean market.

Seventhly, trade promotion efforts should be strengthened. To attract and create a better environment for businesses, the governments of both countries need a reasonable legal framework, especially a transparent information sharing mechanism. Local governments should propose project options for businesses to participate in. Support should be provided to small and medium-sized enterprises through training programs, helping them access each other's markets, especially in marketing, logistics, and payments. Trade promotion activities such as events, fairs, and exhibitions should be organized to provide opportunities for businesses from both countries to meet, exchange, and seek partners. Businesses should be supported in promoting their products on international e-commerce platforms and online marketing channels. The readiness for cross-border e-commerce in Vietnam should be enhanced through businesses strengthening cooperation with government agencies and strategic partners to equip knowledge and provide training for domestic SMEs, promoting the development of service providers in the industry, and expanding knowledge and experience sharing activities in the business community.

Last but not least, diplomatic efforts should be strengthened. The existing trade agreements between Vietnam and Korea should be leveraged to facilitate cross-border e-commerce activities. Exchanges and cooperation, as well as interactions with Korean businesses in the field of e-commerce, should be organized to learn from experiences and share information. High-level dialogues should be strengthened, with regular meetings and high-level talks held between the leaders of the two countries and relevant ministries to discuss cooperation issues, including e-commerce. The Ministry of Industry and Trade, along with other ministries, should be recommended to build bilateral e-commerce platforms, creating an online platform for businesses from both countries to trade and promote products. At the same time, detailed information about the Korean market should be provided to Vietnamese businesses, helping them seize opportunities and face challenges.

REFERENCES

- Ministry of Industry and Trade. (2023). Vietnam's Import-Export Report 2023. Hanoi: The Publisher of Industry and Trade.

- Vietnam E-commerce Association VECOM. (2024). Vietnam E-commerce Index Report 2024.

- Ministry of Industry and Trade. (2023). Vietnam E-commerce White Paper 2023. Department of E-commerce and Digital Economy.

- Thuong Truong Magazine. (2020). "Cross-border e-commerce is increasingly developing, what should Vietnamese businesses prepare?" Thuong Truong Magazine.

- Nguyen Minh Trang (2020). The impact of the Vietnam-Korea Free Trade Agreement on the Vietnamese economy.

- Department of E-commerce and Digital Economy. (2023). Forum to expand cooperation in the Korea-Vietnam E-commerce Market.

[1] Master of Economics, Department of Market Research and Forecast – Vietnam Institute of strategy and policy for Industry and Trade