EXPORT OF METAL COMPONENTS AND SPARE PARTS TO THE EUROPEAN UNION IN THE CONTEXT OF EVFTA

11:46 - 21/08/2021

M.Econ. Nguyen Quang Tuan, M.Econ. Nguyen Manh Linh, Nguyen Duc Kien, Pham Ngoc Dung

Vietnam Institute of Industrial and Trade Policy and Strategy

European Union (EU) is the market with a great demand for supporting industrial products, especially metal components and spare parts. In Vietnam, this is also an area that attracts a lot of enterprises to invest in production and has provided quite well for assembly enterprises, especially foreign direct investment enterprises. The free trade agreement between Vietnam and the European Union (EVFTA) opens up many export opportunities for metal components. Many customers from EU are looking for and developing suppliers in Vietnam. However, this is a market with very high technical requirements and characteristics, so businesses face many difficulties when promoting sales. To promote the export of metal components and spare parts to EU, it is necessary to have strong solutions both from the Government and enterprises.

Keywords: Export; Metal components; Spare parts; Supporting industry.

- The EU's import of metal components and spare parts

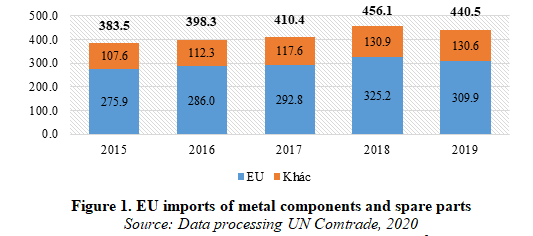

During the development process, EU’s countries have shifted the production lines of supporting industries, including metal components and spare parts to less and developing countries. EU imports metal components and spare parts with great value annually. In 2019, import turnover reached 440.5 billion USD[1], accounting for about 45% of the total import turnover of metal components and spare parts of the world. Of which about 70% is imported from intra-EU countries.

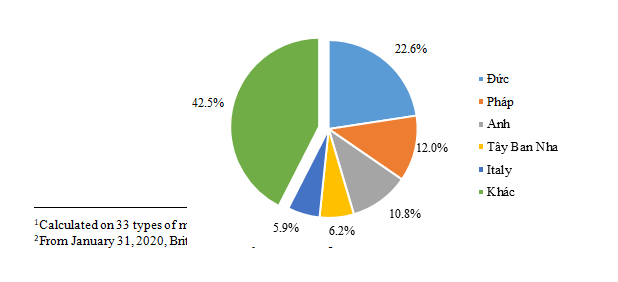

The largest importing countries are Germany, France, and the UK[1]. In which, Germany imported up to 99.5 billion USD, accounting for 22.6% of the total import turnover of metal components of EU.

Figure 2. Share of imports from EU countries

Source: Data processing UN Comtrade, 2020

Types of metal components and spare parts imported the most are motor vehicle parts, with a turnover of 150.1 billion USD, accounting for 34.1% of the total import value of EU. Followed by other products made from metal (67.1 billion USD; 15.2%), engine components (67.9 billion USD; 15.4%), valves, taps (29.7 billion USD; 6.8%).

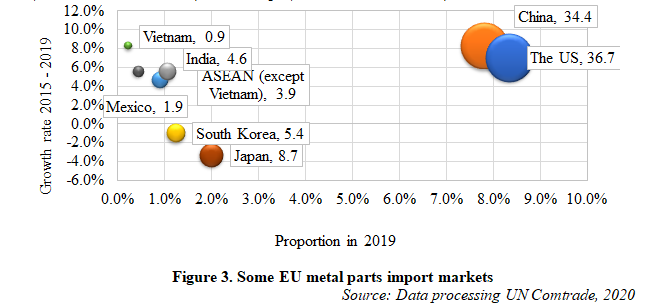

The EU tends to increase parts imports from developing countries, especially in Asia. From 2015 to 2019, import turnover of metal components from China, India, and ASEAN countries all increased while imports from Japan and South Korea tended to decrease. In 2019, EU imported up to 34.4 billion USD of all kinds of metal components from China, an average growth of 8.3%/year. Meanwhile, import from Japan was 8.7 billion USD but decreased by about 3.3%/year. Imports from ASEAN (except Vietnam) were 3.9 billion USD, growing by 4.7%/year. Imports from Vietnam are not high, turnover is 0.9 billion USD but growing fast, average about 8.4%/year.

- Manufacturing metal components and spare parts in Vietnam

In recent years, the supporting industry is an area that the Government of Vietnam focuses on prioritizing and encouraging development. Specifically, the Government's Decree No. 111/2015/NĐ-CP dated November 3rd, 2015 on development of supporting industries and Decision No. 68/QĐ-TTg dated January 18th, 2017 of the Prime Minister on supporting industry development program. Many activities to support business has been carried out, creating a driving force for the development of supporting industries.

According to the Vietnam Industry Agency, Ministry of Industry and Trade, as of 2018, Vietnam has more than 1,800 enterprises producing components and spare parts, attracting more than 240,000 employees, the industrial production value is about 382 trillion VND (current prices). In which, metal component production thrived. In some industries, metal components have met the needs of domestic production and assembly, especially for FDI companies investing and manufacturing in Vietnam. Regarding technical technology capacity, enterprises have gradually invested in upgrading and equipping modern machines and equipment. The fields of pressure machining, precision machining, mold manufacturing, jigs, and automation have developed quite rapidly. Competitive factors in terms of quality, cost, delivery - QCD are also continuously improved by businesses, meeting the requirements of domestic and foreign customers. Advanced management tools such as ISO 9000 (quality management system), ISO 14000 (environmental management system), 5S, Kaizen have also been widely applied by businesses.

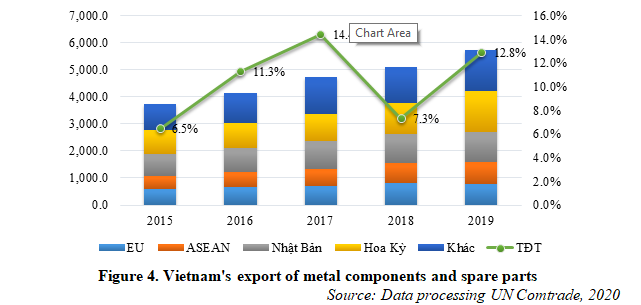

Currently, Vietnamese enterprises have fairly good capacities in fields such as motorcycle and bicycle component production; non-standard mechanical components; manufacture of molds and fixtures. These products have been exported to many countries around the world. By supplying to the FDI enterprise system, Vietnamese enterprises also export indirectly, thereby participating deeply in the global supply chain. In 2019, the export turnover of metal components in Vietnam was 5.7 billion USD, an average growth of 11.4%/year. The main export markets are the United States (1.5 billion USD), Japan (1.1 billion USD) and ASEAN countries (811.5 million USD). Export products with high turnover are other products from ordinary metals (1.3 billion USD), motor vehicle parts (948 million USD), furniture parts (845 million USD) and valves, taps (699 million USD).

In 2019, the export turnover to EU is 784.9 million USD, an average growth of 7.5%/year. Main export products are nails, screws, bolts, nuts (249.8 million USD), bicycle parts (164.7 million USD), and other non-metallic products (117.3 million USD), parts for motor vehicles and motorcycles (108 million USD). However, metal components imported from Vietnam account for only a very small share, about 0.2% in EU. Only 3 products with a market share greater than 1% are bicycle parts (accounting for 2.9%), motorcycle parts (2.3%) and nails, screws, bolts, nuts (1.5%).

In the coming time, the metal component and spare part manufacturing sector will have good conditions for development. The EVFTA also opens up export opportunities for Vietnamese businesses. Especially when Vietnam is the second country in ASEAN and the first developing country in the region to sign an FTA with EU. Besides, the US-China trade tensions and the Covid 19 epidemic have shifted global supply chains, opening up opportunities for Vietnamese supporting industry enterprises to participate. However, EU is a market with very strict technical barriers, highly competitive and relatively new to Vietnamese component and spare part manufacturers. Therefore, businesses face many difficulties when entering this market. Some of the main difficulties are as follows:

- a) QCD factors: when exporting to EU, Vietnamese enterprises will have to compete fiercely with global enterprises, especially countries with developed manufacturing industries. Currently, the QCD competitiveness of Vietnamese metal component manufacturers is still limited. In particular, it is very difficult for enterprises to compete on price because most of the materials (fabricated steel) and machinery and equipment for production are imported. The geographical distance between Vietnam and EU will also greatly affect the cost and delivery time.

- b) Production technology: Although there have been many improvements, the technological capacity of Vietnamese enterprises is only at an average level. The degree of association and production cooperation between enterprises, especially domestic and FDI enterprises, remains low. Some basic manufacturing processes in the mechanical industry such as casting, forging, heat treatment, and surface treatment are lacking and weak, leading to the inability to manufacture finished products according to customer requirements. On the other hand, the investment capital for mechanical manufacturing projects is very large, with low profits, so it is less attractive to investors.

- c) Lack of appropriate quality management standards: When developing suppliers, in addition to mandatory standards such as CE marking, REACH, RoHS, EU customers are also very interested in enterprise management systems such as quality management, labor safety, social responsibility...Currently, the main customers of Vietnamese metal component manufacturing enterprises are from Japan and Korea, so the standards and management styles of EU market are quite new. Vietnamese enterprises have applied to popularize the management system ISO 9000, ISO 14000.However, very few enterprises apply specialized standards such as ISO/TS 16949 (used in the automobile and motorcycle manufacturing industry), ISO systems for social responsibility, occupational safety, or high-level tools such as LEAN, 6 Sigma, TPM…

- d) Lack of information and market access skills: Currently, metal component manufacturers are mostly small and medium-sized, mainly exploit the domestic market through available information and relationships. Enterprises lack information and skills to research, access and exploit export markets. The number of enterprises participating in international manufacturing fairs, especially those in Europe is very small. Even when customers access to order, businesses also have difficulty negotiating contracts due to a lack of international trade skills.

- Solutions to promote export of metal components and spare parts to EU market

On August 6th, 2020, the Government issued Resolution 115/NQ-CP on solutions to promote the development of supporting industries. The resolution has introduced many new solutions, which emphasize the promotion of market development at home and abroad to facilitate the development of supporting industries and processing and manufacturing industries with priority for development. This will be an important premise for issuing policies and programs to support businesses in the coming time, and to promote exports to EU market, proposing some specific solutions as follows:

- For the Government

(i) Attracting investment in the fields of mechanical engineering

As analyzed above, investment in mechanical projects requires a large investment capital but low profits, so it is difficult to attract investors. The Government should have preferential policies to encourage mechanical manufacturing projects to apply modern technologies, meeting international standards, especially fundamental technologies that are weak at domestic such as embryo production, heat treatment, surface treatment.

Besides, it is necessary to have policies to develop business incubators and encourage business incubation activities in the mechanical engineering industry. Create favorable conditions, have a credit guarantee mechanism so that investors, mechanical and manufacturing enterprises can access preferential loans, long-term loans for investment and development.

(ii) Promoting information activities on EVFTA and EU market to enterprises

Currently, businesses lack information, especially specialized reports on EU market. Therefore, it is necessary to strengthen the construction and dissemination of research, analysis and forecasts on the market of metal components and spare parts in EU. Organize workshops, training courses on EVFTA and the needs and requirements of EU customers. Study on building a portal about EU market to introduce, share and update information between Vietnamese businesses and businesses from EU.

(iii) Supporting businesses to meet technical barriers of EU market

Organizing training courses on production technology and management systems following the requirements of EU market. Focus on training on technology and product trends, standards for metal components, quality management systems and tools suitable for EU market, international trade skills.

Implementing business support programs to meet CE marking, REACH, and RoHS standards. Supportbusinesses to build and apply management systems ISO 14000, SA 8000, OHSAS 18001 and productivity - enhancing tools popular in EU such as TPM, LEAN; 6 Sigma.

Establishing a network of local support specialists, especially localities with strengths in metal components and spare parts production. Through a network of experts, implement direct assistance activities at each business.

(iv) Promoting trade promotion activities

Focusing on building national brands on metal component manufacturing industry and manufacturing industries in EU market. Develop long-term projects to support businesses to participate in specialized manufacturing fairs in EU

Building a database of enterprises, metal component products that can be domestically produced, serving as a basis for promoting linkages between businesses and EU markets and support national trade and investment promotion activities. Through diplomatic missions, the Vietnam Trade Office in EU, increasing information about Vietnamese businesses to EU businesses, associations and organizations.

Researching, building and applying modern forms of commerce such as electronic trading floors, online shopping and trading websites to reduce costs and increase the efficiency of business connection.

- For the business

(i) Researching and selecting specific products and markets

The EU has a very rich demand for metal components and spare parts. Therefore, enterprises need to research and choose suitable products, markets and technology. From there, building a specific marketing strategy and plan in the medium and long term. This will be the basis for businesses to build and implement activities to improve their competitiveness to meet the needs and requirements of EU customers.

(ii) Technology capacity building

Industrial Revolution 4.0 is having a strong impact, changing the production method in the world and posing urgent requirements for technology innovation for mechanical enterprises. Enterprises need to research and develop a specific technology innovation roadmap towards more flexible and smarter production.

(iii) Proactively apply management systems and tools suitable to EU market

Not only EU market, but the application of international management systems will help businesses cut waste and improve their competitiveness when joining the global production network. To successfully apply modern management systems, businesses need to be determined to implement and allocate an appropriate budget and time.

(iv) Strengthening market development activities, approaching customers

Enterprises need to actively research and update information about EVFTA and EU market. Actively participate in support programs of the Government, provide and update information on the database. Actively participate and seek partners at seminars, fairs, and events connecting domestic and foreign manufacturing. Building human resources for international trade, fostering foreign languages, searching and market exploitation skills for marketing staff.

In summary, for metal components and spare parts, EU is a market with great potential but also many challenges. To export to EU, deeply participate in the global production network, enterprises need determination and efforts to improve their competitiveness, in terms of technology, technique and management style. This also requires more support and coordination from agencies, organizations and industry associations.

REFERENCES

1.Vietnam Industry Agency, 2018, Project: Organizing a survey and assessment of Vietnam's supporting industry's capacity in manufacturing, Supporting industry development program 2018

- Le HuyenNga, 2020, Promoting supporting industries in Vietnam to join global supply chains, https://vjst.vn/vn/tin-tuc/3038/thuc-day-phat-trien-cnht-o-viet-nam-tham-gia-chuoi-cung-ung-toan-cau.aspx

- CBI, 2016, Buyer Requirements: Metal parts in Europe, https://www.cbi.eu/market-information/metal-parts-components/buyer-requirements

- EVFTA introduction website of the Ministry of Industry and Trade, http://evfta.moit.gov.vn/

- World Bank, (2020), World Bank Integrated Trade Solution (WITS), http://wits.worldbank.org/